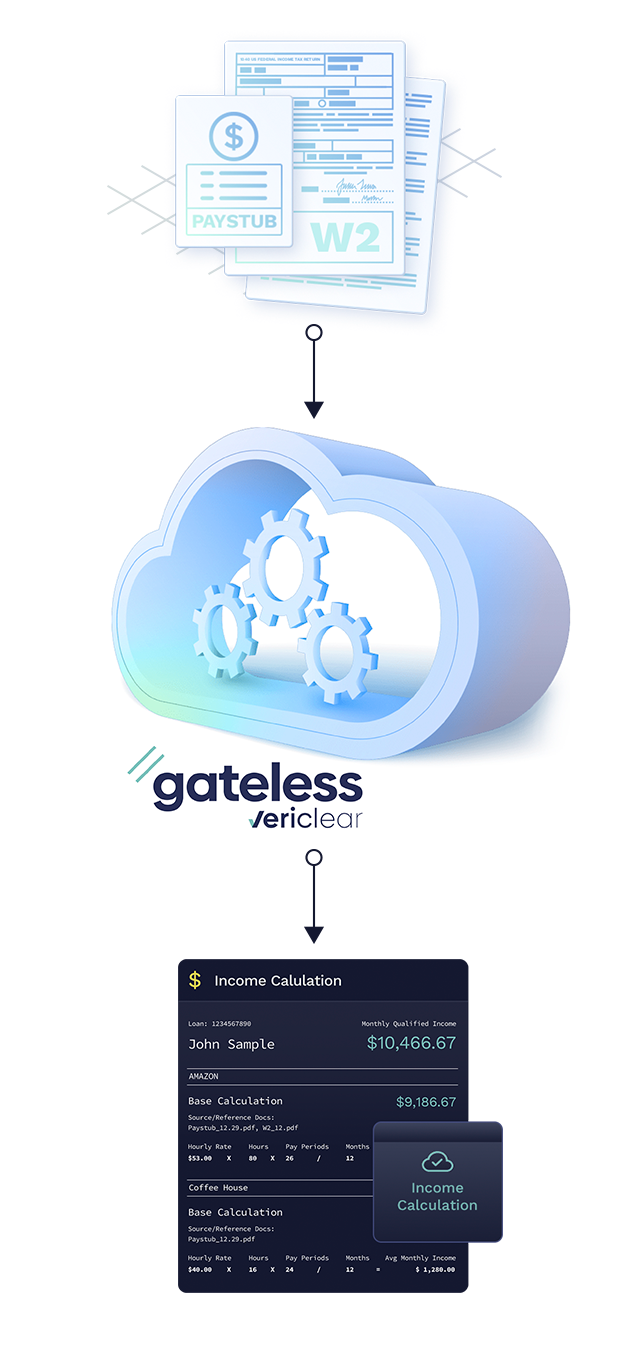

Digital verification using borrower supplied documentation

Gateless VeriClear™ extracts data, calculates income, and offers the opportunity for investor rep and warranty relief.

Request DemoFaster Loan Approvals

Automated income review drives faster initial underwriting decisions

Risk Reduction

Reduced opportunity for human error means lower chance of repurchase

Increase Operational Efficiency

Automation of tasks results in more net output

The future of income verification

While trusted, direct source, income data from a GSE / Gateless partner should generally be considered the preferred origination path for lenders, the fact remains that in the real world 50% of income data used by underwriters today is sourced from borrower supplied documents.

So, here’s the good news….. Vericlear has you covered, regardless of which way you obtain borrower income data!

With Vericlear, you still have a faster path to clearing conditions and loan approvals, coupled with the benefit of potential rep and warranty relief through our partnership with Freddie Mac.

In some cases, particularly when considering today’s compressed operating margins, leveraging borrower supplied documents, and Vericlear, is actually a great alternative to using the services of much higher priced direct source data providers.

Request DemoVeriClear™ in Action

Automated income analysis made easy

Borrower provided income documentation

Automated review and calculation with potential rep and warranty relief